In today’s hyper flow of information and data, making a quick and clear choice has become more time consuming than actually executing a decision. Most common example of this I can relate to is how every weekend when we sit as a family to watch any movie, the initial time is spent just browsing the plethora of apps (Netflix, Sony Liv, Disney Hotstar, Amazon Prime) and its options thrown to you. Each one of us have our own thoughts on which would be the best movie to watch on that day and generally first 30 minutes are spent just to settle for an acceptable option to all! Compare this to my childhood days when our Doordarshan gave us no such option – either of the movie pick nor the time when they would be beamed. Imagine today’s kids or even ourselves being put it in to that situation!

Relating the same analogy to our financial investments we are all in the same boat. The amount of investment option information available today at a click of a button would confuse any beginner more than provide clarity. Asset allocation mantras, mutual funds advertisements, insurance pension plans, balanced funds, retirement plans, direct stock analysis on twitter feeds, cryptos, NFTs etc. is too much information to handle when you want to make a simple decision to start your investment journey. It’s a matter of luck as to where and how you start this journey – if its parents influencing you then options like real estate, life insurance policies, fixed deposits etc. will be the most common avenues you would hear. If its your peer circle direct equity, small case, mutual funds could be possible options and if you are in a circle of “early adopters” cryptos, NFTs are the most in-thing!

So how do we make this choice? If anyone has started evaluating these options, the most common dilemma they get stuck with eventually is – should I opt for Mutual Funds or invest in Stocks directly? General assumption is that the – conservative investor (Fixed Deposits, Real Estate, Endowment Policies) and the more ambitious investor (Cryptos, NFTs) are not the default options chosen by the average junta nowadays with available information and easy avenues to invest.

So, which is the better choice to make? MFs or Direct Equity? Below pointers should help you decide a little better,

When to invest in Direct Equity (Stocks)?

The very first aspect that you should settle in your mind when doing direct equity investing is that you own a part of that business and not just the daily share price movements. You become a minority shareholder of a company in the real sense and your investment gains are going to be directly governed by how well that underlying business does on Quarter-on-Quarter and Year-on Year basis. If investment into stocks is made with this thought, the amount of research or the reason you would buy that business would be way different than just a random price movement buy or sell decision. Common points to keep in mind while investing in direct stocks,

- You should have sufficient time and passion to follow the share market and business performance on daily, monthly, quarterly basis.

- Financial background is critical – basics of balance sheet reading, profit and loss statements, understanding the macro, micro picture of the company and sector.

- Are you buying stocks for trading – by reading technical charts and movements (9am -3.30pm full time work) or buying it for long term by analyzing business fundamentals – fund house research reports, company quarterly, annual reports and conference calls.

- Risk is always the highest and alpha generation (returns above normal) takes time and patience – sometimes many years or a decade too based on the business chosen to invest.

- Investing decisions needs quarterly review (minimum) to track business performance. It cannot be invest and forget option like a Fixed Deposit or PPF.

- Long term wealth generation needs accurate buy and sell calls to be made on regular basis. Insufficient diversification, risky bets can make you lose both time and money. Money is recoverable but time is not.

- There is no guarantee of returns – a consistent and great business will make you increase your investment value consistently over long period of times, inversely a bad business can make you lose your investment in double quick time. Maximum drawdown can be 100% of your investment and at the same time the potential to generate returns is unlimited!

- Starting small (no of stocks) by researching known businesses or sectors will be more helpful in maintaining your conviction of the investment than buying large chunk of unresearched stocks in the name of diversification. Your circle of competence can only increase gradually and even then, it will be a lifelong learning process.

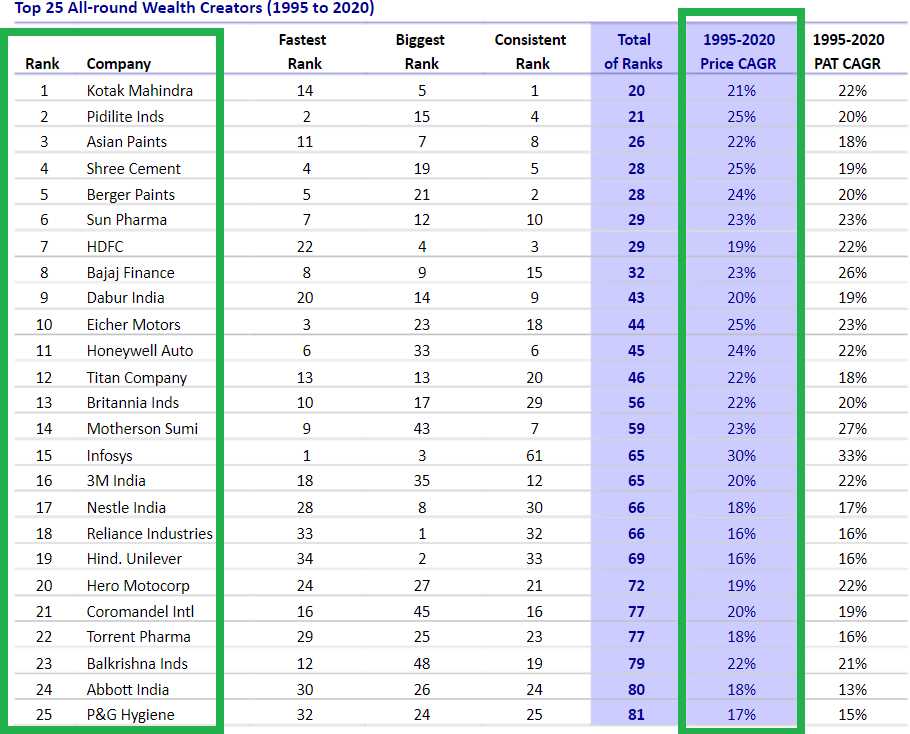

Source: Motilal Oswal 25th Wealth Creation Study

What’s the takeaway?

Direct stock investment as you would observe from above wealth creators is not easy though very enriching in the long term. Amongst the universe of over 5000+ listed securities to pick a set of winners would require constant study and razor-sharp focus on business performance. Also there is no guarantee of one sector outperforming always, the multitude of businesses available itself creates a huge task for us to increase our circle of competency on an ongoing basis. Inspite of what you see or hear from any retail investor who invests in stocks directly, majority of them are taking speculative bets or performing momentum trading than taking deep research calls for long term. So need to be mentally prepared before jumping in to direct stocks, more so if this field does not earn you your daily bread and you need to dedicate time elsewhere non-optionally.

When to invest in Mutual Funds?

Mutual funds are a form of trust which collects money from number of investors to invest it further into equities, money market instruments, bonds or other securities. It’s the easiest way to own a set of businesses in any part of the world with added advantage of risk-diversification, sector-diversification, country diversification and overall fund management by professional fund managers. These fund managers job is to review business performance, allocate the investment appropriately and provide you a more stress-free ownership vis a vis direct equity buying. The income or gains these mutual funds generate is distributed proportionately amongst the owners in the form of Net Asset Value (NAV units) minus their management fees.

The obvious question arises if both direct equity and mutual fund underlying investment objective is same (owning and gaining from performing businesses) then which is the better choice? The choice is in fact based more on your own personal time bandwidth but below are few pointers on when you should opt for Mutual Funds,

- If you are an Individual with limited knowledge on market, market caps, reading business performance but still aspiring to create wealth from the growing Indian and International economy on ongoing

- If your asset allocation is skewed in favour of traditional and conservative avenues including Fixed Deposits, Real Estate (long-term yielding lesser or inflation adjusted returns only) or Physical Gold (Indian Family’s favorite!) which has inherent theft

- If your career and interests do not align with finance in any manner nor do you have the passion to learn this field beyond

- If your wealth generation capacity is no way linked to you getting into this asset class. General reason for anyone to dabble in stock market is the lure it provides to generate above normal returns and create additional wealth beyond the basic investment options. e.g: A successful artist, language professor, sportsperson are not expected to be financially astute and are better off opting mutual fund route via financial

- Your risk appetite is moderate, and you are not comfortable generally with very high-risk Any major drawdown in your corpus is an unacceptable proposition.

- Time is Money and if you are passionate about your own hobbies and pursuits like painting, travelling or sports, getting in to company conference calls or reading annual reports over weekend may not be an attractive proposition at all! Mutual Funds’ investments can always be reviewed over a 6month – 1 year period to make any changes by engaging a financial advisor.

- It’s proven over long period that Mutual Funds perform much better than traditional investment avenues (FDs, Real Estate, Gold etc.) including direct stock investment too specially if you are a beginner. A larger portion of your investible corpus in Mutual Funds and a smaller portion which you can afford to lose in direct equity would be the right option to begin with if you want to learn the tricks of the trade of equity market investment advisor.

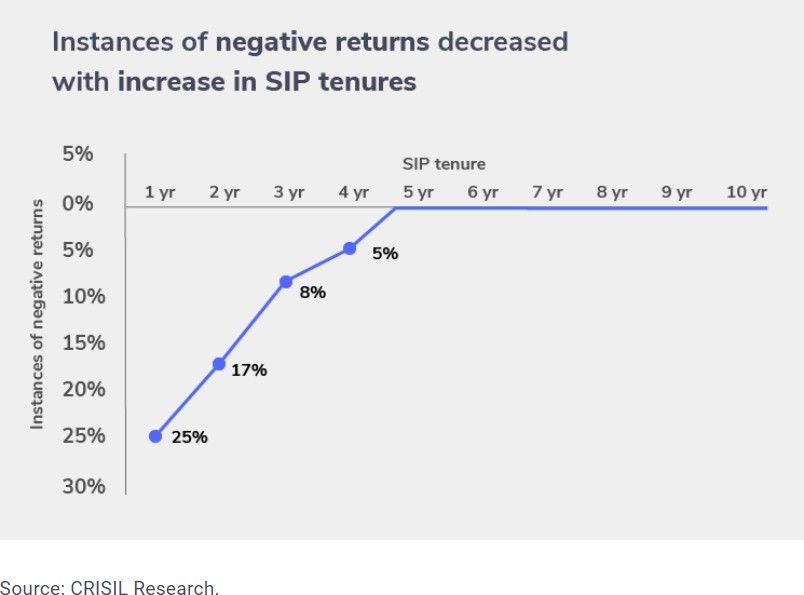

- Regular disciplined investments (like SIP) provides you almost 100% protection from negative returns if continued beyond 5 years as shown in CRISIL research chart below.

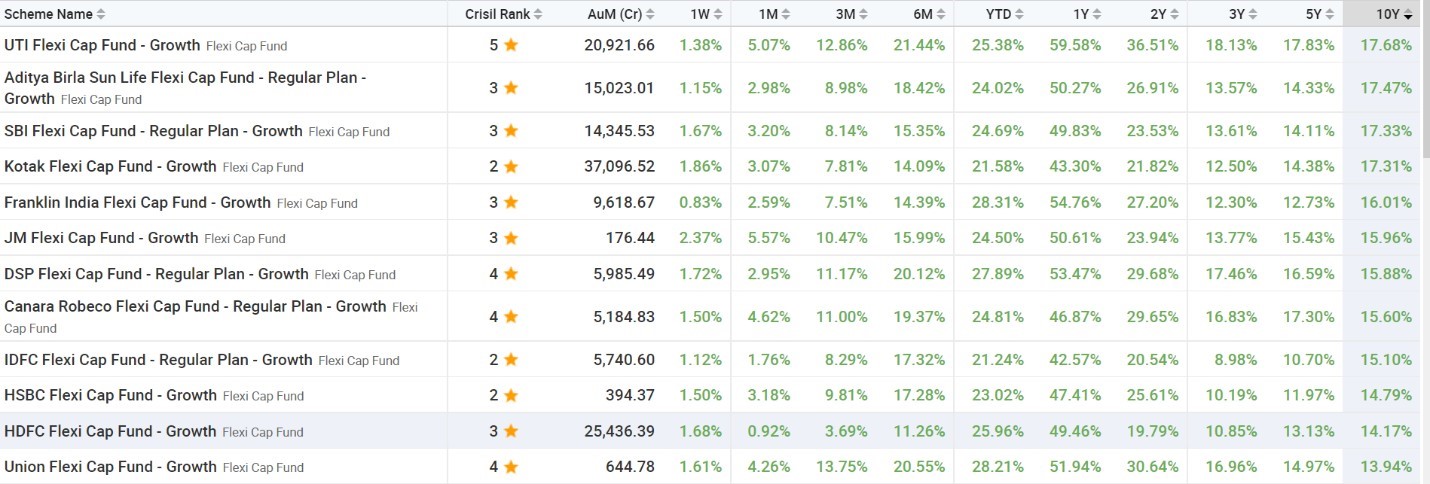

Flexi Cap Performance Snapshot over 10 years

Source: Moneycontrol

What’s the takeaway?

Mutual funds seems to be the easier option amongst the two if you are convinced about equity market investing. Though, its fraught with same level of risk of underlying business performance albeit in a less dramatic fashion due to inherent diversification rules in any fund. Picking the right mutual fund based on your own financial goals, timelines and securing the accumulated wealth becomes very important when you are invested into MF too. Also choosing the right mutual fund and reviewing its performance on regular basis is critical to your success in making gains from this mode of investment. Longer and the more disciplined the period of investment better are your chances of gains!

How and where do I start?

Nowadays there are innumerable avenues for anyone to start their equity investment journey (direct stock or mutual funds). Some of the tools are listed below for reference but a simple guideline is when you are new to the financial investment field, having an experienced financial advisor makes lot more sense than learning through trial-and-error mechanism. More importantly all investment decisions which have a major impact on your long-term financial wellbeing should be made with financial goal- planning in place for it to be successful. A yearly review and guidance from certified advisors in this field will give you that much more confidence to carry on and stay the course always. As they say, the biggest hurdle in wealth creation in equity markets is our own biased behavioral tendencies. Outsourcing this to dependable or proven financial experts cuts-out this risk to a large extent otherwise it’s a steep learning curve.

Basic Tool Requirements

- Opening a Demat account on your personal name. Common and popular zero brokerage providers are Zerodha, PayTM money, Upstox, Groww, Angel Broking etc. Common and popular savings bank account attached demat providers are HDFC securities, ICICI securities, Kotak Securities, SBI Demat The choice of zero brokerage accounts versus savings account linked demat account is a matter of personal preference and associated risk perception. Personally I always recommend a savings bank linked DeMat account even at slightly higher cost for the guarantee of safety and guidelines associated with bank accounts by RBI and SEBI.

- For Mutual funds all above options work in addition to national financial distributors like NJ Financials, Funds India These options are specially preferred by Financial Advisors or Mutual funds distributors for ease of partnering and transactions.